9/11 Questions

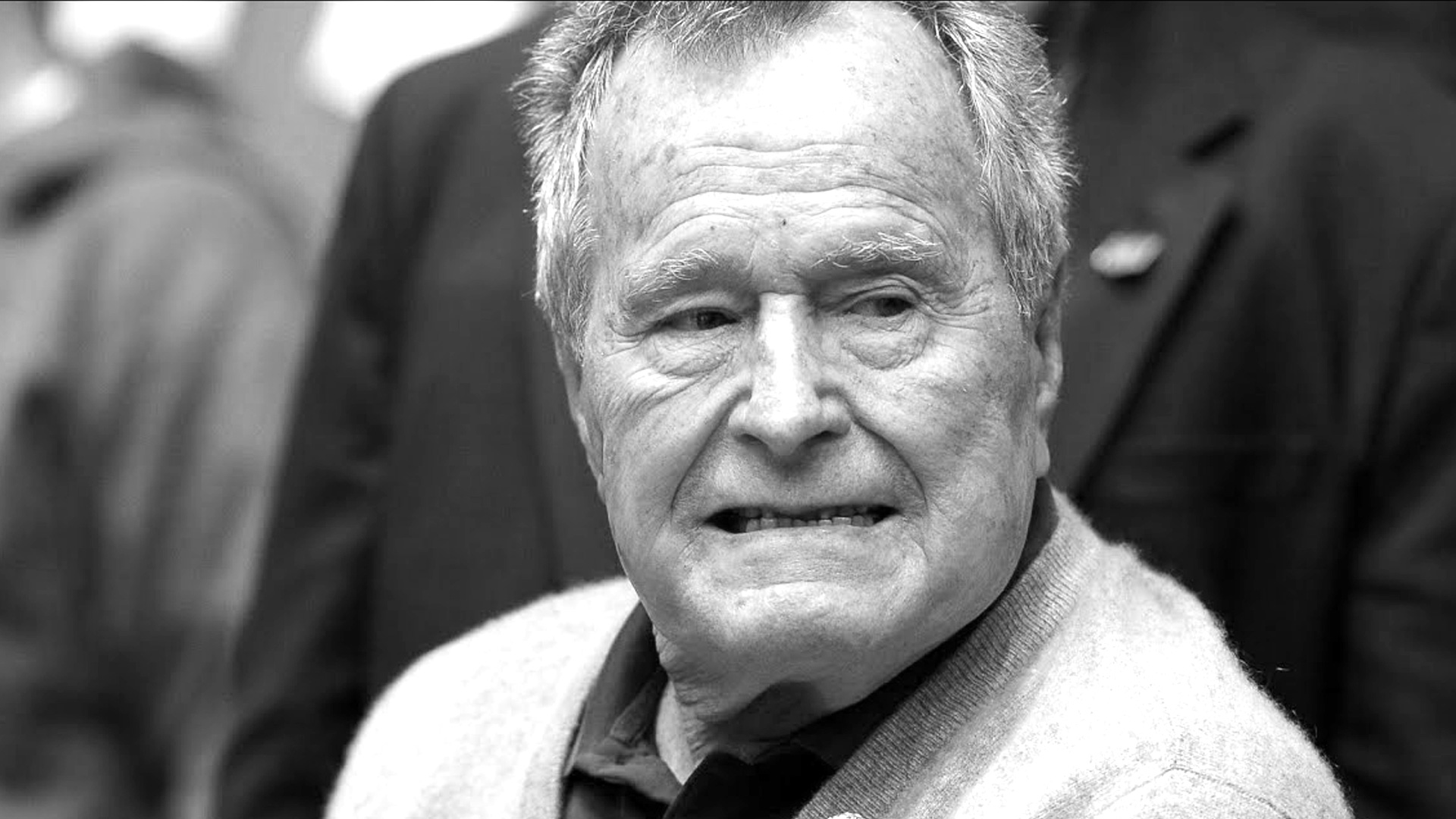

Bush Sr. Meets with Bin Laden Family on Behalf of Carlyle Group on 9/11

Former President George H. W. Bush, attended a conference at the Ritz Carlton hotel in Washington, DC. Among the guests of honor was Shafig Bin Laden.

September 11, 2001: Bin Laden Brother Attends Carlyle Group Conference

The Carlyle Group is a large private-equity investment firm, closely associated with officials of the Bush and Reagan administrations, and has considerable ties to Saudi oil money, including ties to the Bin Laden family. This morning it is holding its annual investor conference at the Ritz Carlton hotel in Washington, DC. Among the guests of honor is investor Shafig Bin Laden, brother of Osama Bin Laden.[Observer, 6/16/2002; London Times, 5/8/2003]

Former President George H. W. Bush, who makes speeches on behalf of the Carlyle Group and is also senior adviser to its Asian Partners fund [Wall Street Journal, 9/27/2001] , attended the conference the previous day, but is not there today. [Washington Post, 3/16/2003]

The Carlyle Group is one of the most powerful and successful private equity firms in the world with $13 billion under management and with more political connections than the White House switchboard. George Bush Sr, his former Secretary of State James Baker, former chairman of the Securities and Exchange Commission Arthur Levitt, the retired IBM boss Lou Gerstner, and John Major, the former Prime Minister, are among the big names on the Carlyle payroll. The chairman is Frank Carlucci, a former Secretary of Defence and Deputy Director of the CIA, a close friend of Donald Rumsfeld, who put Carlyle at the centre of the American defence industry.

With the ascension of George W. Bush to the presidency, the White House is now full of ex-Carlyle employees, friends and business partners. And with the newly fattened defence budget, Carlyle has been able to extract massive profits from its defence holdings. THE same morning as American Airlines Flight 11 roared towards the north tower of the World Trade Center the Carlyle Group was holding its annual investor conference. Among those who gathered in the plush setting of the Ritz Carlton hotel in Washington were former world leaders, former defence experts and wealthy Arabs from the Middle East.

There with them, looking after the investments of his family, was Shafiq Bin Laden, Osama Bin Laden‘s estranged half-brother. George Bush Sr. was also at the conference, but left before the terror attacks. It is impossible to say when it dawned on the partners at the Carlyle Group that what was to come, as a direct result of September 11, would serve their financial interests. Perhaps it was that very day, in the midst of the chaos and grief that had gripped the nation.

Or maybe it was the next day, when President Bush characterised the attacks in no uncertain terms as “acts of war”. Regardless, there was little doubt by the third day after the attacks that Carlyle was in for some heady times. Congress overwhelmingly approved $40 billion in emergency funds, about half of which was earmarked for the armed services.

Also in the works was a massive increase in the Pentagon budget, $33 billion, in time for the Department of Defence’s 2002 fiscal year, beginning October 1, 2001.

But before cashing in Carlyle had to deal with a public relations crisis. Carlyle had been doing business with dozens of families and businesses throughout the Middle East since the early 1990s. And they had been extremely successful in the region.

After all, the company had been running the Saudi Economic Offset Program for years, a government-funded program designed to encourage foreign investment into Saudi Arabia, under the condition that a portion of the profits be reinvested in Saudi Arabia.

In a sense, Carlyle had become the gatekeeper to foreign investing in Saudi Arabia. Not many people were aware of any of this at the time of the September 11 attacks. But by the end of September, the general public would know far more about Carlyle‘s business than anyone Carlyle was comfortable with. In the weeks following the attacks, the name Osama Bin Laden leaped on to the forefront of America’s consciousness as public enemy number one.

Then, on September 27, The Wall Street Journal ran a story entitled “Bin Laden Family Is Tied to U.S. Group“. That group, of course, was Carlyle.

Carlyle had a relationship with the bin Ladens that began in the early 1990s, when they tried to put together a deal for the Italian Petroleum (IP) company. At the time, Basil Al Rahim, a young Carlyle associate, was travelling from Saudi Arabia to Amman to Bahrain, to United Arab Emirates, drumming up support for Carlyle‘s forthcoming international funds. One of the clients that Al Rahim helped secure was the Bin Laden family, which owned a $5 billion construction business by the name of Saudi Binladin Group.

The Bin Laden family consists of more than 50 brothers and sisters, all the progeny of Mohammed Bin Laden. Osama had his Saudi citizenship revoked in 1991, and was reportedly cut off from his family. Since his father’s passing, Bakr Bin Laden became the head of the business and the family, and as such he committed money to Carlyle on several occasions. It was a fruitful relationship for both parties involved. But now, in the most atrocious irony of Carlyle‘s history, the bin Laden family was in a position to make millions from the war being waged against their own brother. The news that George Bush Sr., James Baker and other Carlyle worthies had visited the bin Ladens in recent years stunned the American public. It was, in fact, the Carlyle Partners II fund in which the bin Laden family was invested. The same fund that held a host of defence holdings.

Carlyle told the press that the Bin Ladens were only in for $2 million, a relatively small amount of money considering the whole fund was worth $1.3 billion. But one bin Laden family financial representative says the number was much larger. Regardless of the actual amount, the irony ultimately proved too much for Carlyle, and by the end of October, they severed ties to the family, liquidating their holdings. But it wasn’t until a member of Congress called out Carlyle by name that the company started fighting back.

In April 2002, Representative Cynthia McKinney, a Democrat from Georgia, spoke out against “persons close to this administration who are poised to make huge profits off America’s new war”. She went on to say, “We know there were numerous warnings of the events to come on September 11 . . . what did this administration know and when did it know it . . . what do they have to hide?”

Naming the Carlyle Group as an example of the cronyism she was talking about, McKinney was implying that the Bush administration knew the attacks were coming, allowed them to happen, and was now reaping the profits, both financial and political, through its connections to the Carlyle Group. The Republican counter attack lambasted McKinney for a total lack of responsibility. Senator Zell Miller from Georgia called her “very dangerous and irresponsible”. Kathleen Parker, a nationally syndicated columnist, called McKinney‘s statements “idiotic” and bordering on treason.

McKinney would eventually back off a little from her comments, saying, “I am not aware of any evidence showing that President Bush or members of his administration have personally profited from the attacks of 9/11.” But at least part of what she said was dead on: persons close to the Bush administration were in fact in a position to gain financially from the September 11 attacks.

By the beginning of 1993, Carlyle was a somewhat seasoned, if not terribly successful, private equity firm with stakes in ten companies valued at around $2 billion. But then began a rapid transformation, from bit-part player into an international political and financial powerhouse. Starting with James Baker, former Secretary of State under George Bush Sr., Carlyle brought in the high-priced, high-profile talent that would ultimately define the company.

The goal for the fund was $500 million, a relatively modest sum in private equity circles, but five times as much as Carlyle had ever raised. After rounding up almost $150 million from banks and pension funds, the company went after an investor that could contribute both money and fame and get them over the hump. They went after George Soros.

The Hungarian-American Soros already had a reputation as the most prescient and successful investor in the world. So when he agreed to become a limited partner in Carlyle‘s new fund he was bringing far more than just $100 million. With his reputation for making gobs of money, Soros was also jump-starting a fund that would go on to be the most successful in Carlyle‘s history.

By the time Carlyle Partners II closed in September 1996, the fund had raised more than $1.3 billion. From this massive fund, the company would spread its investments all over the defence world. Names like Aerostructures Corp., United Defence, United States Marine Repair, and US Investigations Services dominated the list of investments. And most of them had one thing in common: they depended on government contracts to make a living. Carlyle was really starting to hit its stride in the mid-1990s, both in raising capital and cutting deals. They decided to hit the global scene, using ex-politicos to open doors and wallets. By this time the company had George Bush Sr. casually working for them on and off as a “senior advisor”.

So it wasn’t difficult to hook former UK Prime Minister John Major, as well. He had been America’s ally during the Gulf War, which put him largely in the good graces of Carlyle‘s Middle East investors. And Carlyle had plans to create another massive buyout fund, this time targeted at European companies. The fit was perfect, and in late 1997, John Major became a member of the Carlyle European Advisory Board — just months after he left his post as prime minister in May.

Over the next two years, the company would raise funds for investments in Asia, begin marketing funds to Latin America and Russia, and start up several venture capital funds aimed at smaller investments of up-and-coming companies. It would set up real estate funds in Europe and the US. By the end of the decade, Carlyle stood with more than a dozen funds and close to $10 billion under management. It was officially a juggernaut, and the world was taking notice. The company was hiring politicians from all over the world to further their cause: former President of the Philippines Fidel Ramos; Prime Minister of South Korea Park Tae-joon; former SEC chairman Arthur Levitt. And, of course, George Bush Sr.

Ref: http://historycommons.org/ https://www.wanttoknow.info/030316post https://archives.globalresearch.ca/articles/WAL110A.html https://www.globalresearch.ca/the-bin-ladens-the-bushes-and-911-a-former-us-president-meets-osamas-brother-not-subject-to-anti-terrorism-legislation/5582436

Crime4 years ago

Crime4 years agoPolice Drags Man Out of Home After Neighbor Snitches on Residents For “Illegally Gathering”

Crime3 years ago

Crime3 years agoLawsuit Filed Against WHO, CDC & the Davos Group for Crimes Against Humanity

Government3 years ago

Government3 years agoThe CDC Caught Changing the Definition of ‘Vaccine’ and ‘Vaccination’

International3 years ago

International3 years agoAirlines Warning COVID-19 VACCINATED NOT TO FLY!

0 Comment